Banks A Lot

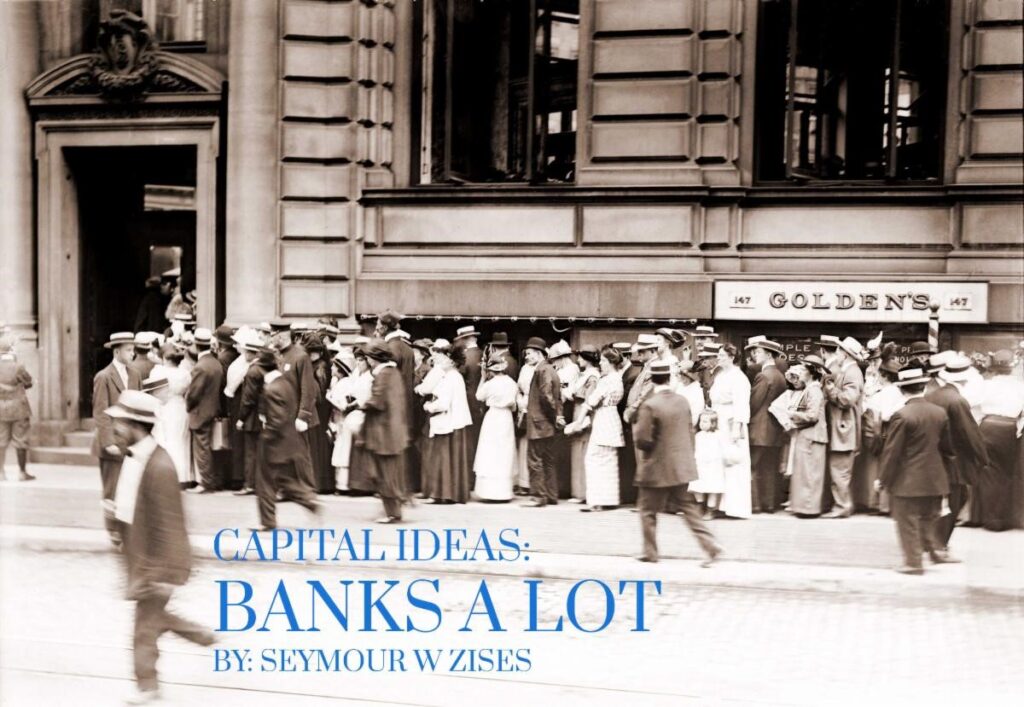

If one were to look back at history, the last time interest rates moved up at this pace was the era when money market funds were born. Money fled from the banking institutions and were invested in short-term treasuries and corporate obligations.

History has repeated itself with the recent crisis involving Silicon Valley Bank and a few others. Compounding the trouble is the ease at which depositors can move their money from a smartphone.

Was the Federal Reserve oblivious to the unintended consequences of raising interest rates at this pace? All of the Government big wigs were old enough to remember the 1980’s. Though the banks made some mistakes, it is our understanding that our government did more to create this problem than any actors in the situation.

Anecdotally the reports from various pollsters show serious deterioration in American Citizens’ hope for the future. It was reported that “Patriotism, religious faith, having children and other priorities that help define our national character for generations are receding in importance to Americans.” Tolerance for others has fallen from 80% four years ago, to 58%.

The aspirations and goals of Americans in one respect, a commercial aspect of life, has improved. U.S. citizens place an ever-increasing importance on financial success. It is that drive that continues to make America a land of opportunity for many – including making CNBC’s “Shark Tank” a hit show.

American ingenuity and technology still lead the world. American businesses are some of the greatest in the world. We are not guessing if the “The Market” will go up or down, if Russia will continue the invasion of Ukraine, or if oil prices will go up or down. We just look to buy quality businesses.

Interest rates plummeted as the government stepped in to guarantee uninsured deposits while leaving equity holders wiped out. As interest rates dropped and crisis was in the air, gold surged, and tech stocks rallied with the prospect of lower interest rates. We are not quite sure interest rates will stay at this level. In our view, the economy is doing better than fine. In order to get inflation down to 2% we believe that the Fed will need to raise interest rates many more times. We could be wrong, but we don’t think so.

Higher and higher interest rates will eventually slow the economy. In turn, that could slow business activity and stock prices may fall. However, this could be a great opportunity, but is yet to be determined.

As Mark Twain said, “A banker is a fellow who lends you his umbrella when the sun is shining, but wants it back the minute it begins to rain”.

Spring and hope ring eternal.

As always,

Seymour W. Zises